Award-winning PDF software

Aicpa Comments On Electronic Filing (E-Filing) Of Forms 706: What You Should Know

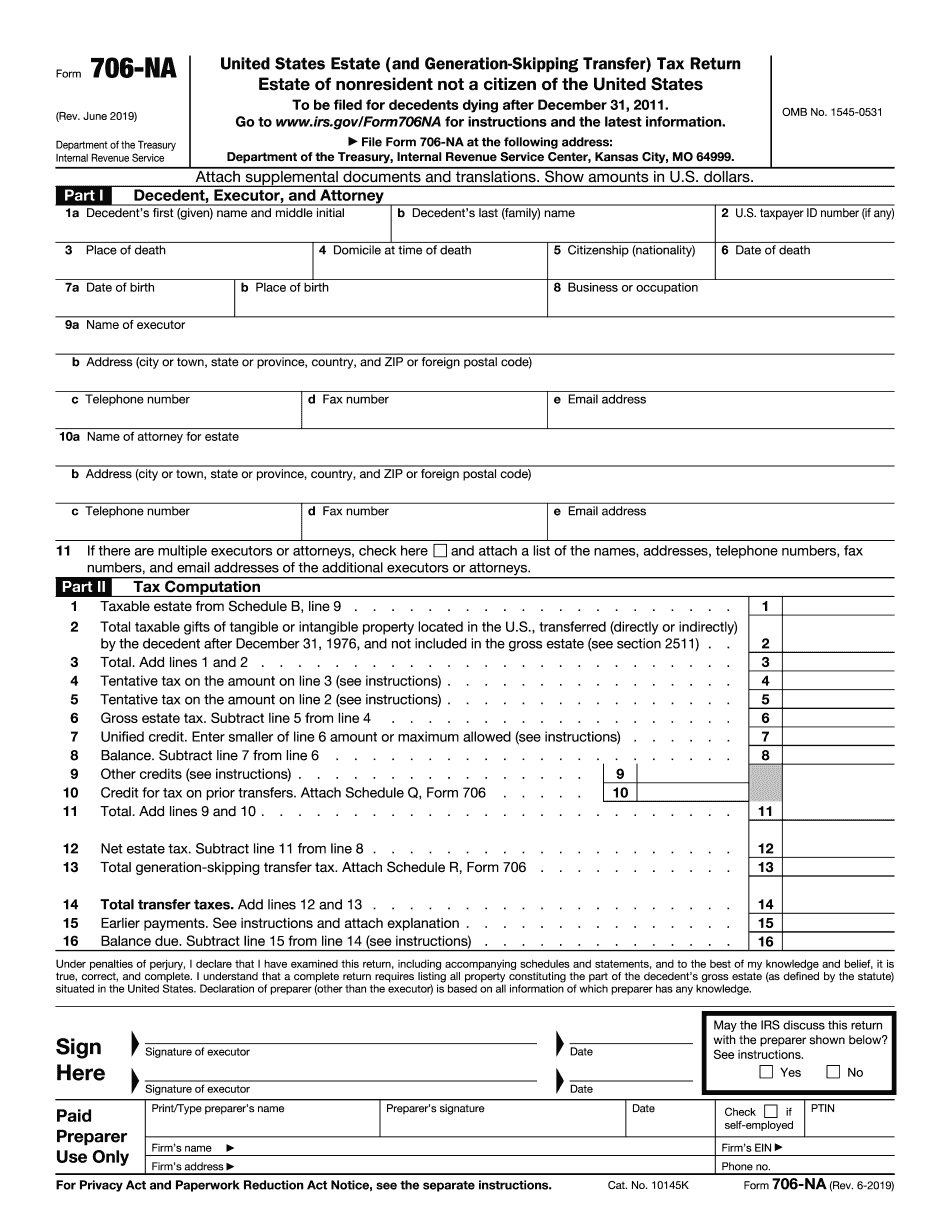

Note: AICPA submitted a comment (letter, form, or e-file) to IRS on May 2, 2017. March 31, 2021—AICPA Comments on Estate Tax Closing Letters for Forms 706 We recommend that Treasury and IRS allow taxpayers access with a checkbox on Form 706 and Form 706-NA for an estate tax closing letter request and paying the user fee Note: AICPA submitted a comment (letter, form, or e-file) to IRS on May 2, 2017. We Recommend Congress Should Move Quickly to Amend the Tax Code to Enact Expanded filing Options and E-filing Requirements for The Individual Taxpayer to Enforce Congress passed by Congress and sent to the President by April 8, 2025 .2 To address our concern for the future of the tax code, we filed comments with Treasury and IRS in response to the request for comments on April 7, 2017. At the February 2025 meeting of AICPA's Tax and Trust Policy Steering Committee, we presented a proposal by the AICPA Tax Policy & Advocacy Policy Advisory Council to Congress that would make electronic filing the default option for the filing of all tax returns (and, possibly, future forms), and that the tax code in general be amended to make it easier to e-file all tax returns, and possibly, future forms, by requiring the filing of a single e-file receipt for all returns.3 In July 2017, AICPA presented our recommendation at a Tax Compliance Association annual meeting in Colorado. This recommendation was further presented at the August AICPA Annual Meeting in Atlanta. We would like to thank the American Academy of Actuaries and the Actuarial Society of America for their continued work one filing. We would also like to thank the Office of Management and Budget [OMB] for their comments and input to the proposal presented by AICPA. Furthermore, we look forward to our continued support of a tax reform package that will move the tax code to include e-filing and other new and enhance defiling options. Thank you. 1.

Online alternatives allow you to to organize your doc management and enhance the efficiency of your respective workflow. Abide by the fast information to be able to finished AICPA Comments on Electronic Filing (e-filing) of Forms 706, refrain from errors and furnish it inside a well timed way:

How to complete a AICPA Comments on Electronic Filing (e-filing) of Forms 706 on-line:

- On the website while using the variety, click Begin Now and go with the editor.

- Use the clues to complete the relevant fields.

- Include your own information and phone data.

- Make confident which you enter right info and figures in best suited fields.

- Carefully take a look at the subject matter in the type as well as grammar and spelling.

- Refer to assist area in case you have any queries or deal with our Guidance workforce.

- Put an electronic signature on the AICPA Comments on Electronic Filing (e-filing) of Forms 706 when using the guidance of Sign Tool.

- Once the form is concluded, press Executed.

- Distribute the all set type by way of electronic mail or fax, print it out or help you save with your device.

PDF editor will allow you to make alterations to your AICPA Comments on Electronic Filing (e-filing) of Forms 706 from any internet linked system, customize it based on your needs, indicator it electronically and distribute in several methods.