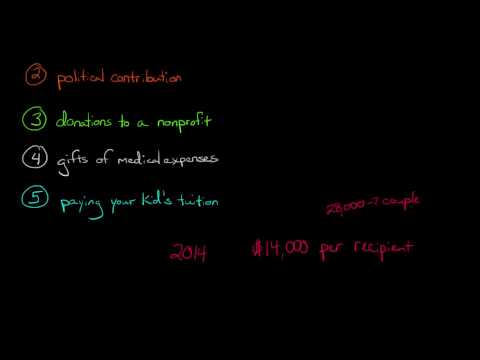

In this video, we're going to talk about something called the gift tax. The gift tax is essentially a tax on the transfer of property. When you give something to somebody for less than its full value, that's when the gift tax comes into play. For example, if one of your parents sells you a car for $1 that is actually worth $5,000, that would be subject to gift tax. It's important to note that the tax is imposed on the person giving the gift, not the person receiving it. So, if someone gives you a gift, like a couple thousand dollars from your parents, you don't need to include that in your income when filing your federal income tax return. However, there are certain thresholds that need to be met in order to incur the gift tax. We will discuss those thresholds shortly. The purpose of the gift tax is to prevent people from avoiding the estate tax. The estate tax is essentially a tax on a person's assets after they die. To avoid this tax, someone with a large estate could give away their assets before they pass away. The government does not allow this loophole and taxes large gifts that fall under the gift tax rules. In addition, they also reduce the amount of exclusion a person will receive for their estate tax. We will provide an example later to further clarify these concepts.

Award-winning PDF software

709-na Form: What You Should Know

In addition to Form 709, these are all the forms one needs to file a gift tax return : Gift or Gift Tax Return Form 709 Taxpayer must file a gift tax return each year that the total value of gifts and inheritances in the year exceeds the annual allowed exemption per IRS instructions. 13 Mar 2025 — IRS Form 8283 reporting the value of gifts made on or after May 1, 2018. For more information on Gift Tax Laws, see IRS Publication 541. Note — This is a brief summary of the gift tax laws. If you have questions about Form 709 or Form 8283, please ask your tax advisor. For further information on the gift tax, visit the IRS website and the IRS Publications website. Back to top Other Forms for Gifts and Estates Tax Considerations Form 809 has two parts: one part must be submitted for each source of your income and one part must be mailed to the IRS. Each part of Form 809 has its own deadlines and procedures to follow. The only certain requirement for Form 1125 is that: 1. The recipient (the person to be named on the document) either: • received the Form 1125 OR • filed a valid Federal tax return for the amount shown on the form. The only certain requirement for Form 807 is that the recipient receive the form. The only certain requirement for Form 1125 is that: 10 Feb 2025 — Form 807 — Gift or Gift Tax Certificate and Certification 13 April 2025 — Form 807 — Gift or Gift Tax Certificate 14 May 2025 — Form 807—Form 807 for individuals For further information on Gifts and Estates Tax, see the IRS website and the Internal Revenue Bulletin. Back to top Annual Gifts and Gains A giver is required by law to file a return of his or her net income for the coming year. Although not required by law, a giver may file one form, Form 1040, 1041, 1202, 1204, or 1205, for a single-person-grand- child or a spouse. This form is filed at the same time as the individual form (such as Form 1040, 1040A, 1040B, or 1040C) is filed. The individual form is then filed and included in the giver's return.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 706-Na, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 706-Na online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 706-Na by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 706-Na from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 709-na